Workers’ Compensation: What’s payroll got to do with it?

Workers' Compensation Perspectives

SEPTEMBER 30, 2019

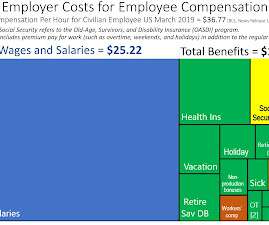

.); "total amount paid to employees over a period," hence, via records-keeping, "list of employees receiving pay." [ See [link] ] Today, the word “payroll” more often than not refers to the department or system that manage employer costs for a range of employee compensation components.

Let's personalize your content