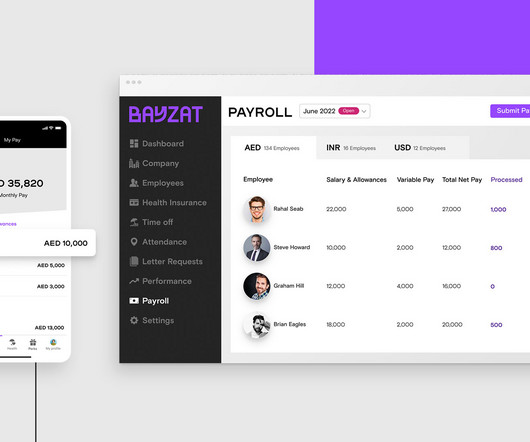

Need for HR Payroll Software

Qandle

APRIL 25, 2023

Businesses have a horrifyingly high potential for error when handling payroll manually. That’s where HR Payroll Software comes into action. A comprehensive HR Payroll Management System offers several benefits that guarantee efficacy, punctuality, consistency, and cost-effectiveness. What is a Payroll Software?

Let's personalize your content