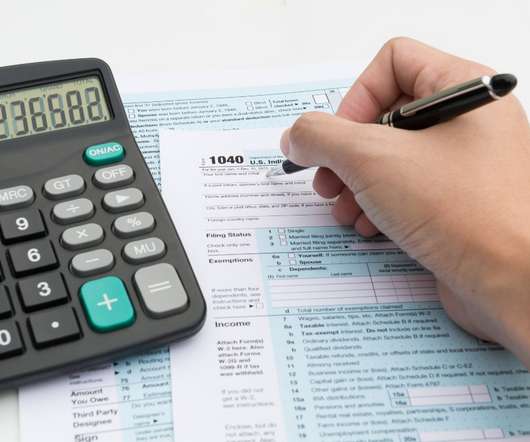

Ten Tax Planning Tips for 2022

Money Talk

MAY 18, 2022

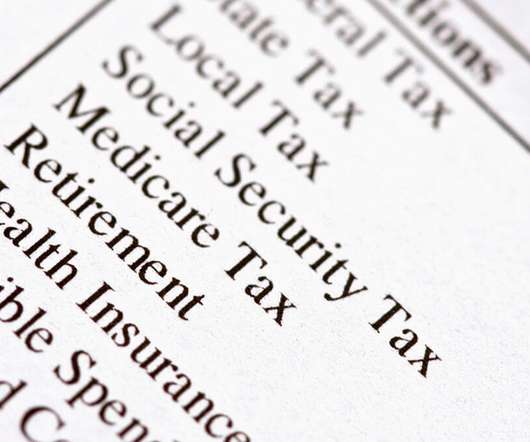

Now that 2021 income tax season has been over for a month and the dust has settled, it is time to start some serious tax planning for 2022. Planning now provides seven months to take action and/or implement changes to avoid a stressful “tax scramble” at the end of the year. assets that are taxed in different ways).

Let's personalize your content