Payroll Process: A Comprehensive Guide to Payroll Processing

Qandle

DECEMBER 5, 2023

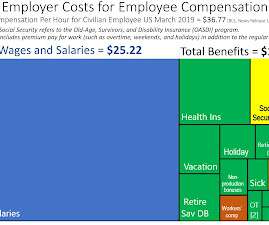

Understanding Payroll Processing: At its core, payroll processing involves calculating employee compensation, including salaries, wages, bonuses, and deductions. Understanding Payroll Processing: At its core, payroll processing involves calculating employee compensation, including salaries, wages, bonuses, and deductions.

Let's personalize your content