$15 minimum wage for federal contractors faces challenges

Business Management Daily

FEBRUARY 24, 2022

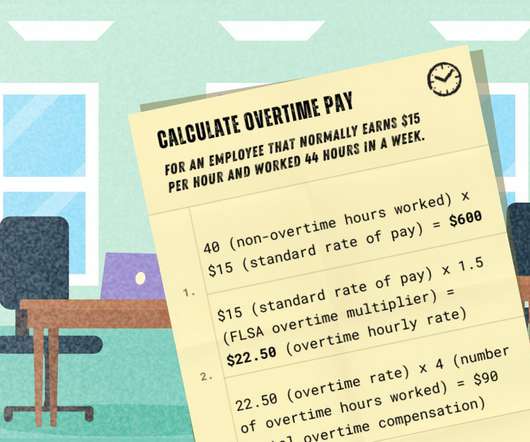

24, 2021, raised the minimum wage for non- exempt employees working for federal contractors to $15, from $11.25, effective for new and renewing federal contracts signed on or after Jan. Procedure—how regulations are written and issued—is everything to federal agencies. The DOL has yet to file an answer.

Let's personalize your content