Payroll Process: A Comprehensive Guide to Payroll Processing

Qandle

DECEMBER 5, 2023

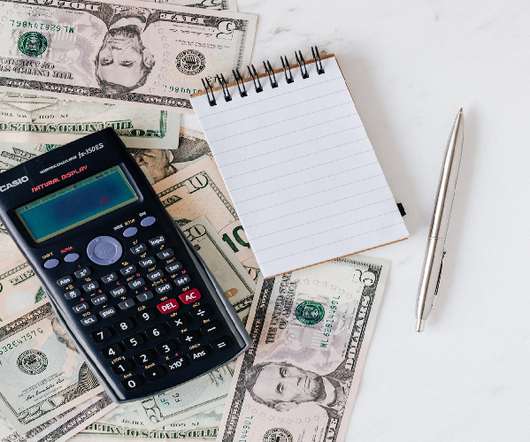

In any organization, efficient payroll processing is not just about paying employees accurately and on time; it’s a critical aspect of employee satisfaction and regulatory compliance. In this detailed blog post, we’ll explore the key components of payroll processing and how organizations can streamline this complex function.

Let's personalize your content