What is an HDHP?

WEX Inc.

APRIL 25, 2024

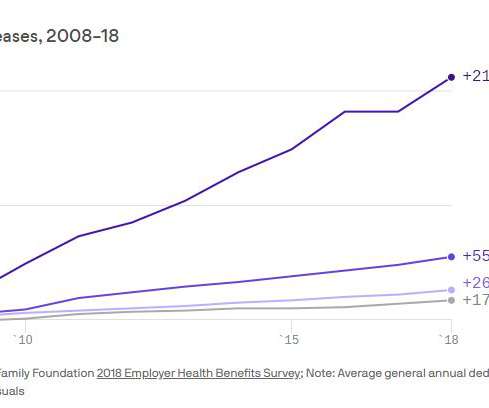

This can include: Basic medical services Hospital visits Emergency services Mental health services And more Key features of HDHPs High deductibles As the name suggests, HDHPs come with a high deductible. This can make HDHPs a great option for saving on monthly payments. Generally, HDHPs have lower premiums compared to others.

Let's personalize your content