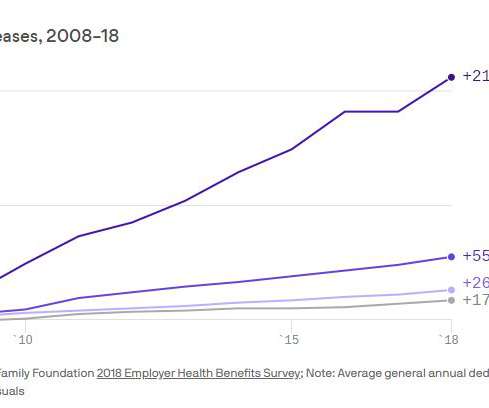

Waiving HDHP Deductibles Has Little Effect on Premiums, Study Says

InterWest Insurance Services

AUGUST 10, 2022

Employers who offer health savings account-eligible high-deductible health plans (HDHPs) to employees can significantly expand pre-deductible coverage for certain drugs used to manage chronic conditions — with only a tiny effect on premiums. Absenteeism. Illness-related presenteeism. Overtime costs.

Let's personalize your content