What is Payroll Tax?

Abel HR

DECEMBER 8, 2020

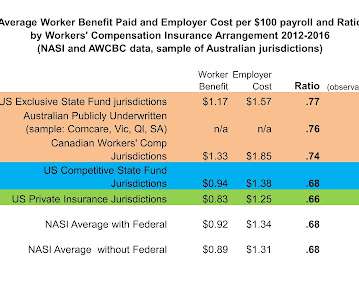

One of the most perplexing topics in the human resources industry is that of the payroll tax. Both employer and employee know about it but unsure of what it is and where it goes. What are Payroll Taxes? When business owners pay their employees’ wages, the law requires them to make tax payments on their behalf.

Let's personalize your content