Payroll vs Compensation: The sempiternal HRIS conundrum

Ahmed's Universe

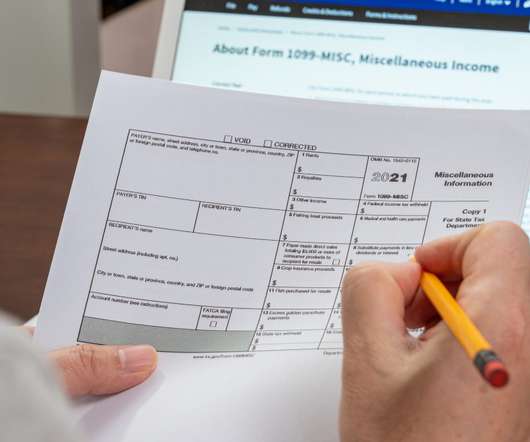

NOVEMBER 11, 2021

Document generation : If there is little doubt that producing a P ayslip is a task best left with your local Payroll tool(s), you may decide that it makes sense from a business perspective that storing it in your new HRIS as part of Employee Documents (depending, of course, on your vendor's technological prowess.)

Let's personalize your content