A Guide to Payroll Management: Ensuring Smooth Financial Operations

Qandle

NOVEMBER 27, 2023

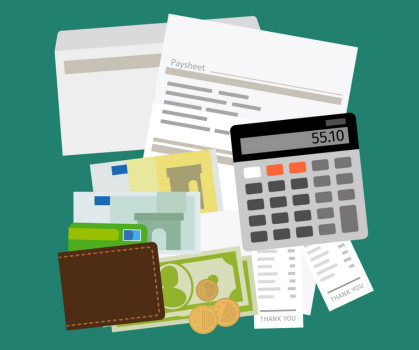

First and foremost, it requires a thorough understanding of applicable laws and regulations related to wages, taxes, and deductions. It encompasses the calculation and disbursement of salaries, wages, bonuses, and deductions in a systematic and organized manner. Effective payroll management involves several key components.

Let's personalize your content