What are employees supposed to do with their excess pretax deductions?

Business Management Daily

NOVEMBER 9, 2020

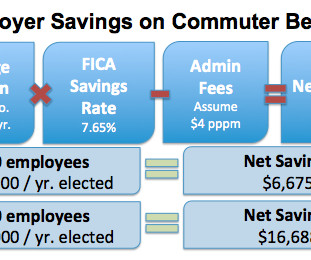

The IRS’ guidance didn’t change the rules regarding what counts as a tax-free dependent care expense—an expense incurred that enables employees to work. Transportation fringes. Tax relief for pretax contributions for transportation fringes—mass transit passes or employer-provided parking—wasn’t included in the IRS’ earlier guidance.

Let's personalize your content