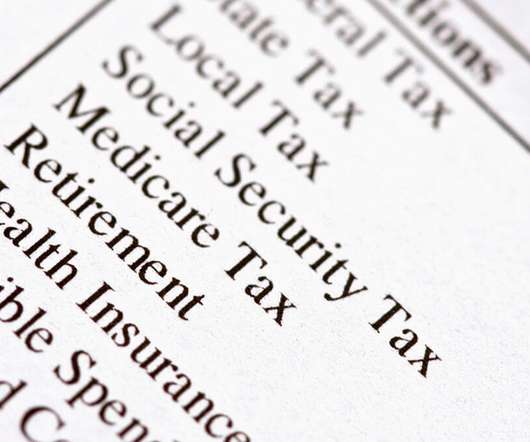

Not Knowing Legal vs. Illegal Payroll Deductions Can Cost You Big Time

Patriot Software

AUGUST 22, 2022

Part of being an employer means running payroll. And chances are, you probably have to deal with a few types of payroll deductions, like 401(k) or health insurance, when paying employees.

Let's personalize your content