A Guide to Payroll Management: Ensuring Smooth Financial Operations

Qandle

NOVEMBER 27, 2023

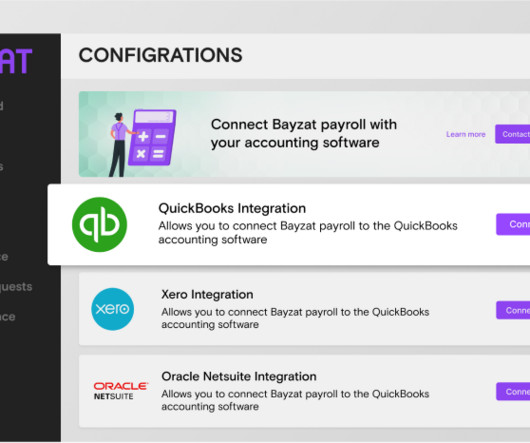

Payroll management is a critical aspect of running a successful business, ensuring that employees are compensated accurately and on time. This guide aims to provide a comprehensive overview of payroll management in a concise manner. Looking for the Best Payroll Management ? Check out the Payroll Management.

Let's personalize your content