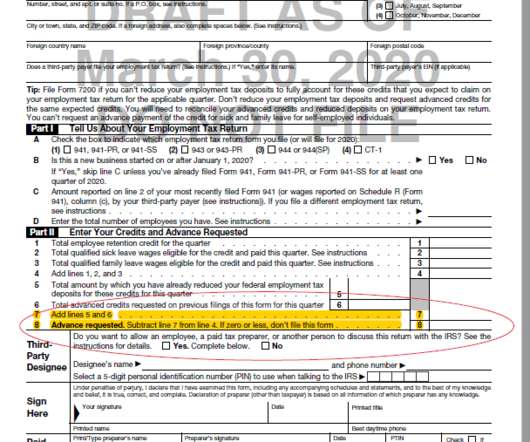

How to Complete Form 941

BerniePortal

OCTOBER 22, 2021

The IRS uses Form 941 to determine how much an organization has withheld from its employees’ wages each quarter. There are specific regulations, requirements, and exceptions when filing this form. Here’s what you need to know about Form 941, including how to correctly fill it out and file it.

Let's personalize your content