Benefits of Payroll Systems for Small and Medium-Sized Businesses and Startups

Qandle

JANUARY 23, 2023

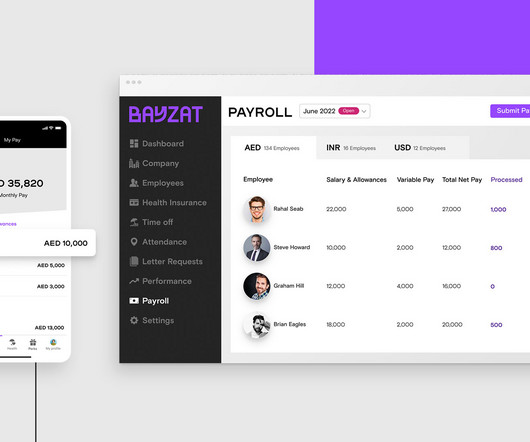

According to a SCORE poll, many small company owners spend more than 41 hours a year on tax computations and payroll procedures. It’s feasible for humans to keep up with their bills and annual tax filings. Employees may access their payroll information anytime using the self-service portals provided by payroll solutions.

Let's personalize your content