The 4 Best Benefits in 2024, According to Employees

Best Money Moves

MARCH 11, 2024

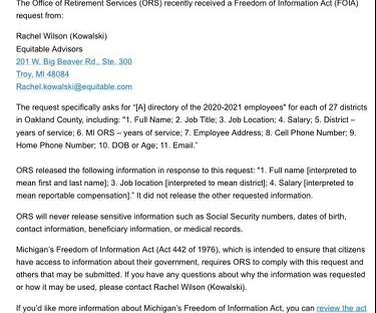

Some lesser-known benefits in this area include virtual team bonding activities, a home office stipend and financial assistance to cover internet costs. Pension and retirement plans The same Forbes Advisor study found that 34% of employees and 34% of employers agree that retirement plans are a vital part of a company’s benefits strategy.

Let's personalize your content