It’s time to review (or create) your document retention policy

Business Management Daily

AUGUST 8, 2022

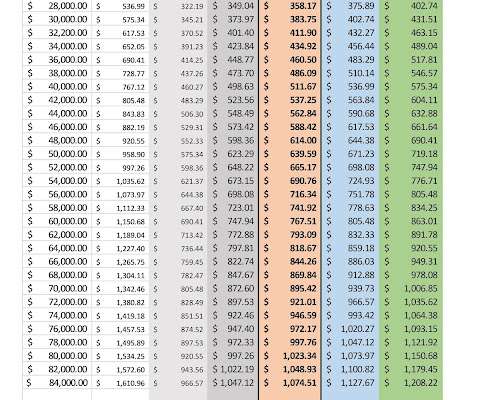

Courts and government agencies frown upon individual employees selectively keeping or tossing important documents. As financial statements, tax returns, and similar types of records will be a concern for all organizations, including your CPA or a similar accounting professional on the team is a smart move. Per the U.S.

Let's personalize your content