A New Normal? Omnibus Bill Extends High Deductible Health Plan Telehealth Safe Harbor

Proskauer's Employee Benefits & Executive Compensa

JANUARY 31, 2023

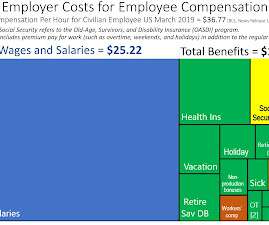

provisions make some significant changes for retirement plans , but CAA 2023 also extends the telehealth plan safe harbor for high-deductible health plans (“HDHPs”) that were first introduced in the 2020 CARES Act. Generally, a participant must pay their HDHP’s deductible before the plan can cover medical services.

Let's personalize your content