United States Trends in Health Insurance for Private Employers

Global People Strategist

JULY 13, 2022

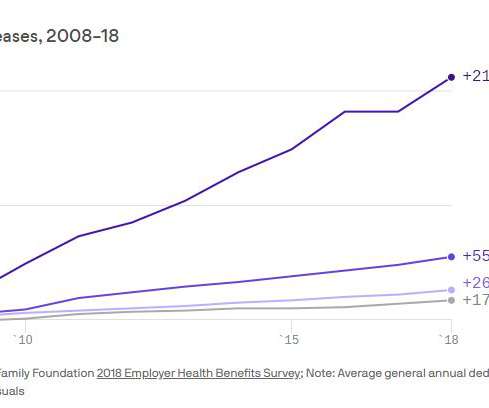

As the cost of healthcare continues to rise, private employers are searching for new and innovative ways to provide health insurance for their employees. Here we will take a look at some of the latest trends in health insurance for private employers. The Rise of High Deductible Health Plans. Final Thoughts.

Let's personalize your content