How to Create a Pay Stub for Employees?

HR Lineup

JANUARY 29, 2024

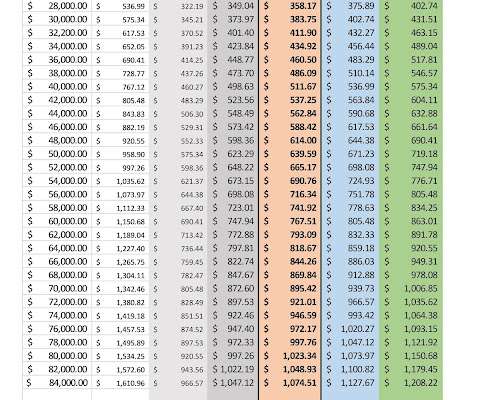

Creating accurate and professional pay stubs is an essential aspect of managing a business. A pay stub not only serves as a record of an employee’s earnings but also provides crucial information about deductions, taxes, and other financial details. A typical pay stub includes the following elements: 1.

Let's personalize your content