Useful Information from 2022 Webinars- Part 2

Money Talk

MAY 31, 2023

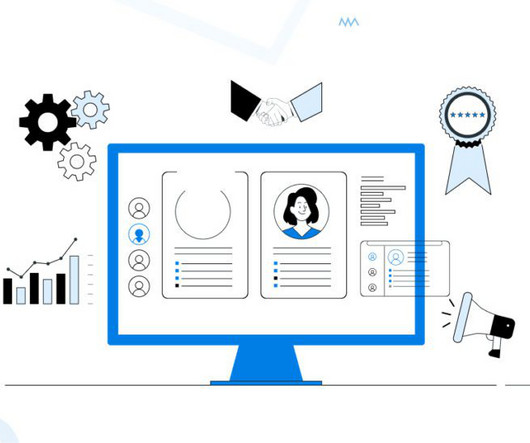

Below are seven information tidbits that caught my eye: Defensive Investing- Financial markets were volatile in 2022 and, for a while, “there was no (good) place to hide.” Tax Planning - Until 12/31/25, taxes are “on sale.” There are only two ways to reduce taxes: 1. When the government lowers tax rates.

Let's personalize your content