An Introduction to IRMAA

Money Talk

SEPTEMBER 30, 2022

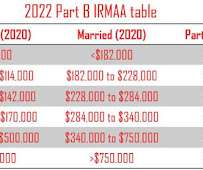

Many are middle income taxpayers who diligently saved and invested for 4-5 decades in tax-advantaged plans. As I wrote in my book Flipping a Switch , some older adults must “plan for higher taxes in the future, especially when required minimum distributions (RMDs) kick in.” IRMAA surcharges. to $573.30 for Medicare Part B and $12.40

Let's personalize your content