Besides Health Insurance and 401(k)s, These Are the Benefits Employees Value Most

InterWest Insurance Services

JANUARY 17, 2023

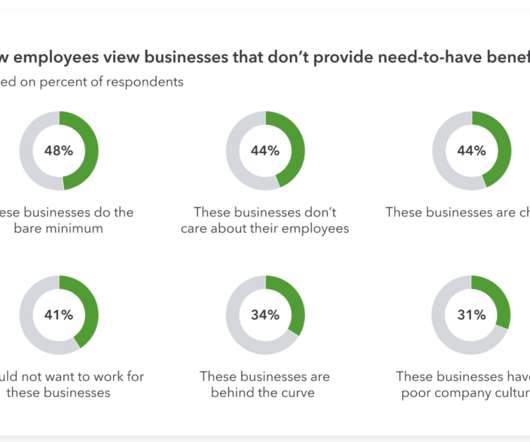

Besides health insurance and a 401(k) plan, other benefits that employees value highly are generous paid time off and flexible or remote work, according to a new survey. Also, with mental health support and resources high on the list for younger workers, employers may consider tapping an employee assistance program.

Let's personalize your content