The Difference Between Employer of Record (EOR) and Professional Employer Organization (PEO)

HR Lineup

MARCH 31, 2023

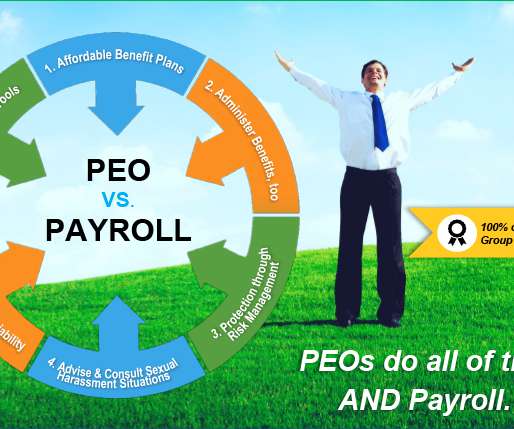

One of the biggest challenges is managing the employer-employee relationship, and this is where Employer of Record (EOR) and Professional Employer Organization (PEO) services come in. They both offer a range of services, including payroll, taxes, benefits, compliance, and risk management.

Let's personalize your content