Can a business pay for employees' individual health insurance plans?

PeopleKeep

MAY 14, 2024

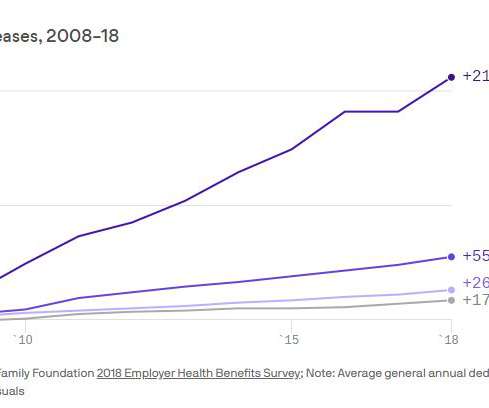

Instead of offering a costly group health plan, one tactic they may consider is offering to pay employees' individual health insurance costs. While it may seem like a generous and attractive perk for employees, employers need to consider several factors before deciding to pay for individual health insurance plans.

Let's personalize your content