The rise of gig workers: Adapting HR strategies for the contingent workforce

Higginbotham

NOVEMBER 15, 2023

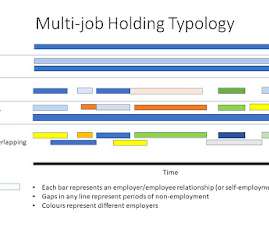

One of the most powerful currents in this tide of change is the rise of gig workers, also known as contingent workers, freelancers or contractors. American Opportunity Survey , 36 percent of all respondents identified as independent workers. How many participate in the contingent workforce?

Let's personalize your content