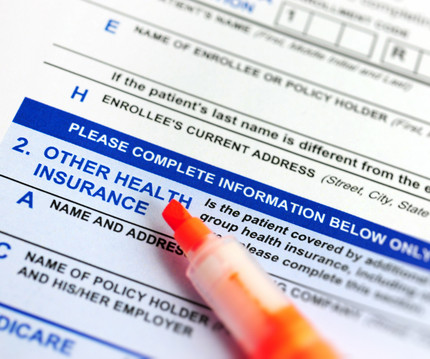

IRS Clarifies Status of Fixed-Indemnity Health Plans Claiming Big Tax Savings

McDermott Will & Emery Employee Benefits

JULY 20, 2023

A recent Internal Revenue Service (IRS) memorandum addresses the tax status of certain fixed-indemnity health plans that promise employers major payroll tax savings. The post IRS Clarifies Status of Fixed-Indemnity Health Plans Claiming Big Tax Savings appeared first on EMPLOYEE BENEFITS BLOG. Read the article.

Let's personalize your content