21 Financial Events and Trends During 2021

Money Talk

DECEMBER 29, 2021

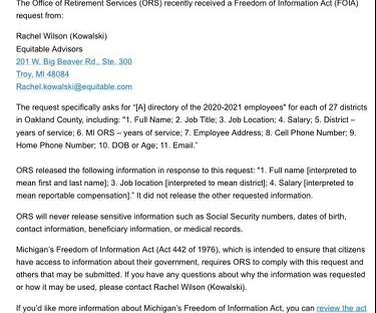

Below is a written summary of these financial milestones and their impact on family finances. Insurance- COBRA premium assistance for health insurance was provided under the American Rescue Plan Act and Medicaid enrollment surpassed 80 million. Both Social Security and Medicare face long-term financing shortfalls.

Let's personalize your content