Contractor Overtime: Overtime Rules for Remote Contractors

HR Lineup

APRIL 2, 2024

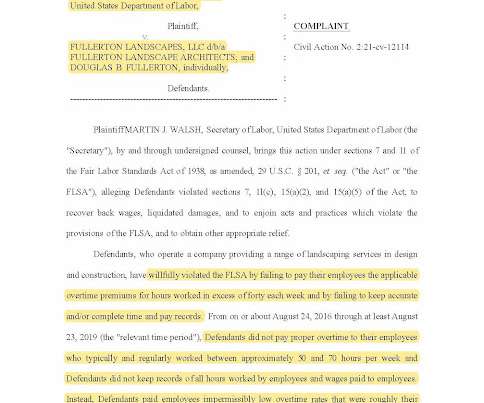

However, amidst the flexibility and convenience of remote work, questions often arise regarding overtime rules and regulations for these contractors. Understanding the intricacies of contractor overtime is crucial for both contractors and the businesses that hire them.

Let's personalize your content