Pensions Dashboards are only part of the picture – people need a wider view of their finances

Employee Benefits

MAY 2, 2024

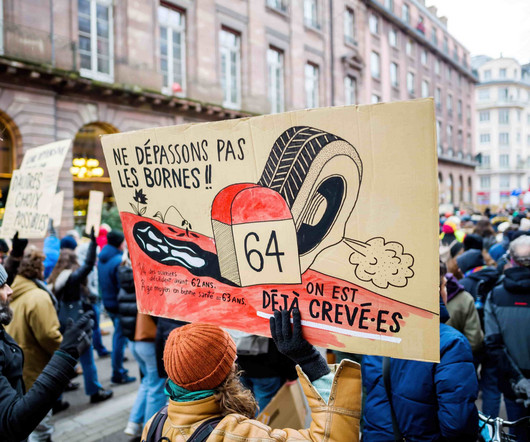

The government has published statutory guidance setting out the staged timetable by which it expects pension schemes to connect to the Pensions Dashboards. With the launch of the Pensions Dashboards approaching there is potential to develop this into ‘Open Finance’ which is an extension of Open Banking.

Let's personalize your content