Utilizing Pre-Tax Benefits to Prioritize Health in 2023

Benefit Resource Inc.

JANUARY 3, 2023

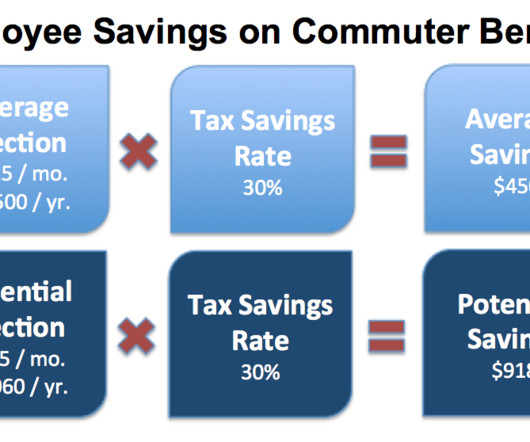

If you’re in the 70% of people who have health-related goals for 2023, let’s take a look at how pre-tax benefits can help set goals and prioritize your health this year and beyond. Add In Pre-Tax Benefits. Plus, any interest earned on the account is tax free and the money is ALWAYS yours! Set SMART Goals.

Let's personalize your content