Your 2021 payroll questions answered.

Business Management Daily

JULY 19, 2021

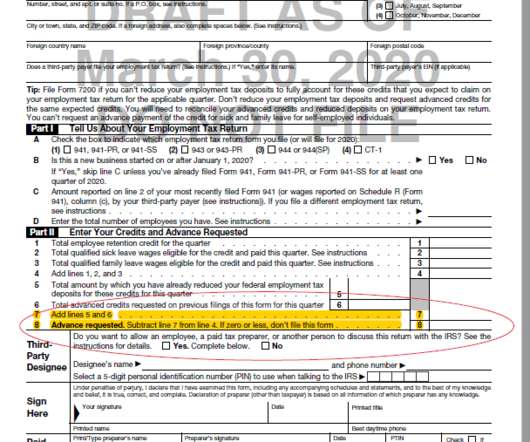

Regardless, you can’t put payroll on hold simply because things are confusing. COBRA tax credits. Our COBRA carrier has provided us with a report detailing the company’s eligibility for the COBRA tax credit for the second quarter. Remote work and payroll software. The FFCRA and accrued sick leave.

Let's personalize your content