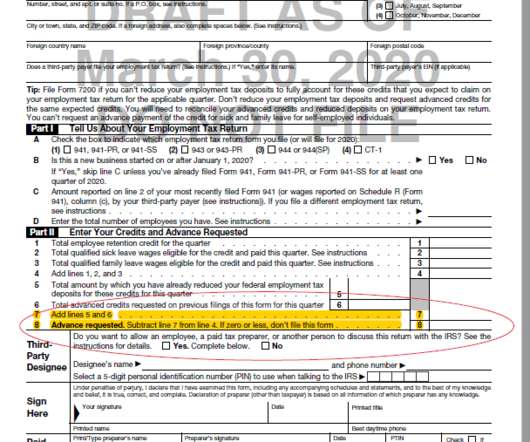

So, I “Bit the Bullet” and Finally E-filed Our Taxes

Money Talk

MARCH 29, 2023

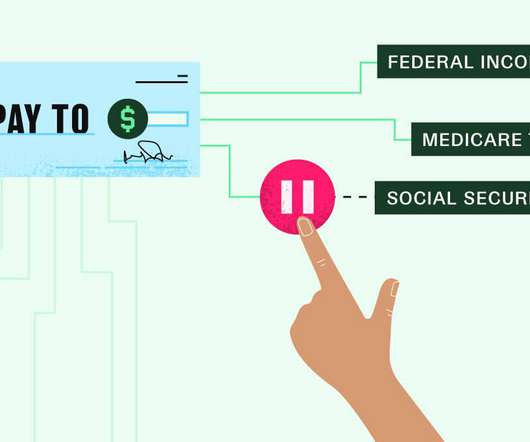

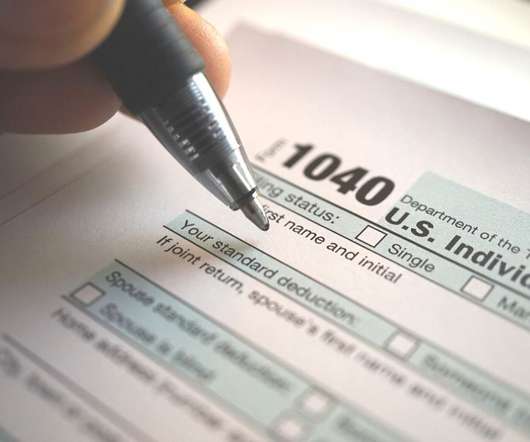

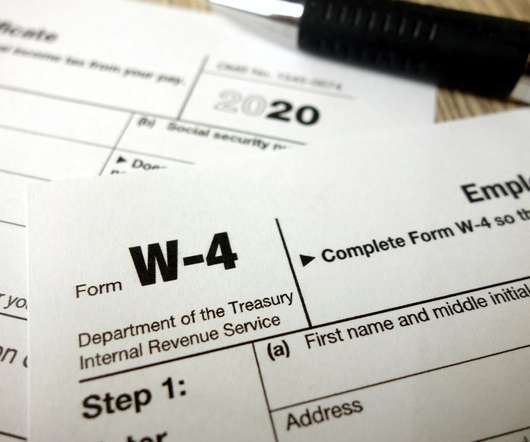

Last year, I wrote a post that described the pros and cons of filing your income taxes by paper or electronically (e-filing). Looking back, it was also a “personal pep talk” for me because I knew I was part of a dying breed of paper income tax filers. of tax returns are filed by paper or, in numerical terms, nearly 13.2

Let's personalize your content