Thirteen Indiana Counties, State Have Tax Rate Changes for 2024

PayrollOrg

JANUARY 11, 2024

Effective January 1, 2024, 13 Indiana counties have income tax rate increases and the state withholding tax rate decreased to 3.05% from 3.15%.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

PayrollOrg

JANUARY 11, 2024

Effective January 1, 2024, 13 Indiana counties have income tax rate increases and the state withholding tax rate decreased to 3.05% from 3.15%.

Money Talk

APRIL 4, 2024

All other tax-deferred plans, like 401(k)s and the thrift savings plan (TSP), must have RMDs calculated separately. Roth Conversions - It is best to move money from a pre-tax account to a Roth account in low-taxable income years, during stock market downturns, and/or in small increments over time. net investment income tax.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PayrollOrg

NOVEMBER 21, 2023

Need help with local payroll taxes? Check out this great local payroll compliance research tool from PayrollOrg, updated for 2024!

Money Talk

DECEMBER 7, 2023

As the year winds down so, too, does your opportunity to take proactive steps to reduce 2023 income tax due in April 2024 and, perhaps, taxes due in future years as well. Below are some money-saving tax planning strategies to consider. Year-to-Year Comparison - Once a draft 2023 tax return is prepared, compare it to 2022.

Money Talk

FEBRUARY 22, 2024

With income tax season well underway, many people are getting ready to see a tax preparer to get their 2023 income tax return prepared and filed before April 15, 2024. Some may have a long-standing tax pro while others are selecting a tax preparer for the first time. About half of U.S. About half of U.S.

HR Lineup

DECEMBER 5, 2023

In the fast-paced world of taxation and financial management, staying ahead of the curve is crucial for tax professionals. As we step into 2024, the demand for efficient, user-friendly, and comprehensive tax practice management software has never been higher.

PayrollOrg

DECEMBER 18, 2023

The Compliance Calendar for 2024 is now available on PayrollOrg’s website. It contains important payroll tax payment and reporting dates every payroll professional needs to know during the calendar year.

Employee Benefits

MARCH 6, 2024

Spring Budget 2024: The government is to cut employee national insurance contributions (NICs) by two pence, falling from 10% to 8% from 6 April. This means that a person on the average wage now has the lowest effective personal tax rate since 1975. But as always, the devil is in the detail. a month and £125.60 respectively.

PayrollOrg

DECEMBER 22, 2023

Effective January 1, 2024, 12 Indiana counties will have income tax rate increases and the state withholding tax rate will decrease to 3.05% from 3.15%.

PayrollOrg

MAY 3, 2024

In this May 2024 edition of Compliance TV: DOL finalizes salary thresholds for 'White Collar' Exemption; IRS data affirms payroll's vital role in nation's tax system; and more.

PayrollOrg

DECEMBER 8, 2023

In late November, the IRS released a worksheet containing the tax tables that will be included in the 2024 Publication 15-T, Federal Income Tax Withholding Methods.

PayrollOrg

AUGUST 18, 2023

Effective July 1, 2024, Vermont employers will be required to make contributions for a new state payroll tax. A portion of the tax may be withheld from employee wages, and the rest must be paid by the employer.

PayrollOrg

NOVEMBER 2, 2023

The IRS announced the changes to the dollar limits on benefits and contributions under qualified retirement plans for tax year 2024.

Proskauer's Employee Benefits & Executive Compensa

NOVEMBER 3, 2023

On November 1st, the IRS released a number of inflation adjustments for 2024, including to certain limits for qualified retirement plans. As expected, this year’s adjustments are more modest than last year’s significant increases. The table below provides an overview of the key adjustments for qualified retirement plans.

PeopleKeep

DECEMBER 11, 2023

Starting in 2024, Indiana employers will have a new tax credit available if they decide to offer their employees a health reimbursement arrangement (HRA) instead of group health insurance. This will allow small businesses and nonprofits to offer affordable and personalized health benefits in The Hoosier State.

WEX Inc.

MAY 17, 2023

Key takeaways - 2024 HSA contribution limits 2024 HSA contribution limits will increase to $4,150 and $8,300 for self-only and family HSAs, respectively. 2024 HDHP minimum deductible and maximum out-of-pocket limits also are increasing. Health savings account (HSA) contribution limits are on the rise again in 2024.

Money Talk

APRIL 11, 2024

The 2023 income tax filing deadline is only days away (April 15, 2024 in most of the U.S.). It will be a busy weekend for many taxpayers and tax preparers who are filing tax returns or tax filing extensions. money that has been taxed) and can be withdrawn at any time for any reason tax-free and penalty-free.

AssuredPartners

AUGUST 13, 2023

Changes for 2024 As 2024 approaches, employers should be aware of the upcoming Affordable Care Act (ACA) reporting changes on the horizon. However, beginning in 2024, employers that file 10 or more returns will now be required to file electronically. The new reporting rules are detailed in full here.

HR Lineup

DECEMBER 1, 2023

As we step into 2024, the market is teeming with a variety of options, each vying to be the best solution for handling contractor payroll. In this comprehensive guide, we will delve into the top 10 contractor payroll software options for 2024, exploring their features, benefits, and what sets them apart.

HR Lineup

FEBRUARY 5, 2024

Any business requires the best payroll software 2024 to manage its employees’ payroll. The software should be very effective to manage taxes and employee benefits. If you are looking for top payroll software in 2024, we recommend them below. The post 8 Best Payroll Software 2024 appeared first on HR Lineup.

AssuredPartners

MARCH 23, 2023

2023-17 , the Internal Revenue Service (IRS) announced the updated employer mandate penalties for the 2024 calendar year under the Affordable Care Act (ACA). For 2024, the §4980H(a) sledgehammer penalty will be $2,970 (or $247.50 For 2024, the resulting number is multiplied by $247.50. With the issuance of Rev. per month).

Best Money Moves

MARCH 11, 2024

The 4 best benefits in 2024, according to employees. Here are the 4 best benefits in 2024, according to employees. Here are the best benefits in 2024 based on input from real workers. Average healthcare premiums for American families increased 7% in 2024, according to research from KFF.

InterWest Insurance Services

SEPTEMBER 7, 2023

The IRS has significantly reduced the group plan affordability threshold — which is used to determine if an employer’s lowest-premium health plan meets the Affordable Care Act rules — for 2024. This is happening just as group health plan premiums are expected to climb at a much faster clip in 2024 than the last three years.

AssuredPartners

SEPTEMBER 11, 2023

Set to begin on January 1, 2024, employers covered under the new law certain employers located within designated Illinois counties and townships, as discussed further below will be required to provide a pre-tax commuter benefit allowing covered employees to utilize pre-tax dollars to purchase a transit pass via a payroll deduction.

Employee Benefits

MARCH 6, 2024

Spring Budget 2024: The government is to maintain the current rates of fuel duty for a further 12 months to help support people with the cost of living. Bradley Post, managing director of RIFT, said: “Where tax cuts are concerned, the Chancellor has said a lot while doing very little for the average household.

HR Lineup

APRIL 4, 2024

As we stand in 2024, it’s imperative to explore the dichotomy between automated payroll and manual payroll systems, understanding their respective merits, challenges, and the overall impact they have on businesses. Calculations, including taxes and deductions, are automated, reducing the potential for errors.

PeopleStrategy

NOVEMBER 14, 2023

Changes are coming to the Affordable Care Act (ACA) in 2024, and HR departments need to take note of them now. This means most reporting entities will be required to complete their ACA reporting electronically starting in 2024. 31, 2014, do not need to test for the current tax year.

Enjoy Benefits

FEBRUARY 18, 2024

Over the next two months, we’re highlighting eight key developments shaping the business environment in 2024, as featured in this Forbes article: The 10 Biggest Business Trends for 2024. FinTech and digital payments The financial technology sector is booming, and in 2024, we can expect continued innovation in digital payments.

Employee Benefits

MARCH 20, 2024

Neurodiversity Celebration Week 2024 this year takes place on 18-24 March. The February 2024 Chartered Institute of Personnel and Development Neuroinclusion at work report revealed that while neuroinclusion was a focus for 60% of surveyed employers, it was only in the business strategy of 33%.

BerniePortal

FEBRUARY 21, 2024

Form W-4 is crucial to employee tax reporting and employer withholding. This form got a major overhaul from the IRS in 2020, but there are some updates for 2024 as well. Many employees don’t know how to fill out Form W-4 correctly– which can lead to an unpleasant surprise when they owe more taxes than expected.

Benefit Resource Inc.

MARCH 20, 2024

March 20, 2024 – Benefit Resource (BRI) , an Inspira Financial solution, has been recognized as Partner of the Year at the 2024 ADP Marketplace Partner Summit held in Atlanta, Ga. In early 2024, Millennium Trust Company rebranded as Inspira Financial. ROCHESTER, N.Y., Learn more at inspirafinancial.com.

Griffin Benefits

JUNE 7, 2023

On May 16, 2023, the IRS released Revenue Procedure 2023-23 to provide the inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs) for 2024. Eligible individuals with self-only HDHP coverage will be able to contribute $4,150 to their HSAs for 2024, up from $3,850 for 2023.

PayrollOrg

MAY 8, 2023

In this edition of May 2023 Compliance TV: IRS Data Affirms Payroll's Vital Role in Nation's Tax System; SSA Releases Tax Year 2023 W-2 Electronic Filing Specs; IRS Said 2024 Form W-2 Will Not Be Redesigned; DOL Publishes Report on UI Trust Fund Solvency, and more.

BerniePortal

NOVEMBER 2, 2023

But with inflation at or near 40-year highs, those changes are especially relevant for 2024. The Internal Revenue Service, or IRS, regularly makes changes to adjust its regulations in response to inflation.

HR Lineup

NOVEMBER 24, 2023

In this article, we will delve into the ten best HR compliance software tools in 2024, providing an in-depth analysis of their features and capabilities. Top 10 HR Compliance Software in 2024 1. It covers a wide range of compliance aspects, including payroll , taxes, and employee documentation. What is HR Compliance Software?

PeopleStrategy

DECEMBER 12, 2023

People like HSAs in part because of their triple tax advantage. Contributions, interest and earnings, and amounts distributed for qualified medical expenses are all exempt from federal income tax, Social Security/Medicare tax and most state income taxes.

Workers' Compensation

DECEMBER 28, 2023

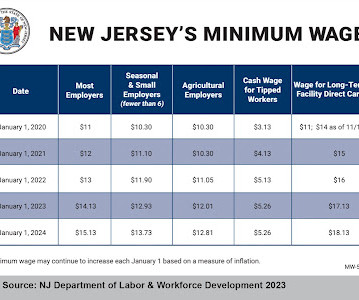

New Jersey is set to become one of a handful of states with a minimum wage of at least $15/hour on January 1, 2024 when the rate increases to $15.13/hour, The benefit rates and taxable wage base 2024 reflect the $1,507.76 NJ Rates to Rise in 2024, www.gelmans.com (12/28/2023), [link] © 2023 Jon L Gelman. million hourly workers.

Employee Benefits

MARCH 6, 2024

Chancellor of the Exchequer Jeremy Hunt will deliver his Spring Budget 2024 speech at 12.30pm on Wednesday 6 March 2024. state pension increase from April 2024, fit note process and work capability reforms, a Value for Money framework update, and occupational health guidance.

Employee Benefits

NOVEMBER 22, 2023

from April 2024. Deep-rooted reforms that consider the interaction of pension savings, tax, and other benefits including care are needed.” increase on the horizon for April 2024. from April 2024 appeared first on Employee Benefits. The state pension will increase by 8.5% in the last uplift and now an 8.5%

Employee Benefits

JANUARY 18, 2024

Our research found that almost half of UK employees say they’re likely to look for a new role in 2024. That’s why SmartPay, our cost-neutral salary deduction scheme, is the employee benefit your people and business need in 2024. It’s hardly surprising that financial health is a 2024 priority for so many in the UK. Affordability.

PayrollOrg

JULY 19, 2023

The IRS said it will provide an electronic filing option for amended employment tax returns “sometime in 2024.”

Employee Benefits

FEBRUARY 14, 2024

The post Kerry Hudson: Change in flexible-working arrangements for 2024 appeared first on Employee Benefits. Any new agreement should be formalised in writing, such as drawing up a new contract of employment outlining the varied terms and signed by both parties. Kerry Hudson is solicitor, personal injury and employment, at BTTJ.

Money Talk

JANUARY 4, 2024

Free money does not have any work requirement, however, and is often income tax-free. 50% for a fifty cent per employee dollar saved match) and is taxed as ordinary income in retirement. Like inheritances, life insurance is generally not subject to income tax. If they didn’t discover their tax error, they would not have it.

Employee Benefits

OCTOBER 3, 2023

Chancellor of the Exchequer Jeremy Hunt has announced that the national living wage will increase to at least £11 per hour from April 2024. The post National living wage to rise to at least £11 per hour in 2024 appeared first on Employee Benefits.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content