Financial Shocks: What You Need to Know

Money Talk

MARCH 7, 2024

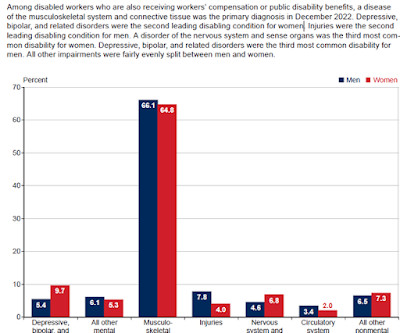

Financial shocks are events that result in unexpected expenses and they are especially challenging for individuals and households with limited resources and tight budgets. childcare, food, insurance, rent, utilities) ¨ Car accidents ¨ Disability ¨ Divorce ¨ Large home repairs (e.g.,

Let's personalize your content