What is Payroll – A Comprehensive Guide, Definition, Processes & Solutions

Qandle

DECEMBER 16, 2023

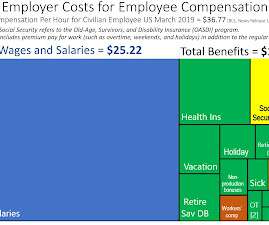

Payroll refers to the process by which employers calculate and distribute compensation to their employees for the work they have completed. It involves various tasks, including calculating wages, withholding taxes and other deductions, and ensuring that employees receive their net pay. Check out the Best 10 HR Software.

Let's personalize your content