How to Create a Pay Stub for Employees?

HR Lineup

JANUARY 29, 2024

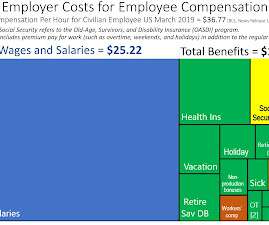

A pay stub not only serves as a record of an employee’s earnings but also provides crucial information about deductions, taxes, and other financial details. Deductions: Federal and state taxes Social Security and Medicare contributions Health insurance premiums Retirement contributions 4. Deductions and Taxes 1.

Let's personalize your content