How to Hire & Pay Independent Contractors

BerniePortal

SEPTEMBER 19, 2023

Independent contractors may be useful to your organization for many reasons, but you must remain compliant when hiring and paying them.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

how-to-hire-pay-independent-contractors

how-to-hire-pay-independent-contractors

BerniePortal

SEPTEMBER 19, 2023

Independent contractors may be useful to your organization for many reasons, but you must remain compliant when hiring and paying them.

InterWest Insurance Services

FEBRUARY 13, 2024

Department of Labor in January 2024 finalized a new federal rule that will make it more difficult for employers to classify workers as independent contractors. Companies who hire contractors that work exclusively for them will have the hardest time trying to continue classifying them as independent contractors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Creating a Company Culture of Care: Integrating Mental Health, Wellbeing, and DEI in Benefits

HR Lineup

APRIL 2, 2024

With technological advancements enabling seamless communication and collaboration from virtually anywhere, remote contractors have become a vital part of many businesses’ operations. However, amidst the flexibility and convenience of remote work, questions often arise regarding overtime rules and regulations for these contractors.

Stratus.HR

JUNE 6, 2022

Record high inflation coupled with low unemployment creates a tough recipe for business owners trying to hire. Many have considered options like hiring teens or enhancing their benefits package to attract more applicants. But what about an alternative solution like paying someone as a 1099 contractor?

Business Management Daily

AUGUST 2, 2022

It has been made even more complex in recent years due to the constantly shifting laws and guidelines regarding independent contractors. On June 3rd of 2022, the Department of Labor announced that it is developing a new proposed rule on determining employee or independent contractor status under the FLSA.

Kollath CPA

MARCH 9, 2022

Are your employees really employees, or are they actually independent contractors? You don’t generally have to withhold or pay any taxes on payments to independent contractors, as you do with employees. You need to weigh all factors when determining whether a worker is an independent contractor.

Insperity

FEBRUARY 9, 2021

It’s a question with big ramifications that trips up many employers: Is my worker an employee or contractor ? Employee or contractor: basic information to help your business. If a worker meets the requirements for an employment relationship, they can’t be an independent contractor. Additionally, on Jan. 6, 2021, the U.S.

InterWest Insurance Services

SEPTEMBER 13, 2022

Supreme Court’s decision to not hear an appeal of the sweeping California independent contractor law known as AB 5 is likely to cause serious personnel headaches for motor carriers in the Golden State. How the law works. They must be customarily engaged in an independent trade or occupation. . The effects.

Business Management Daily

AUGUST 10, 2022

The use of freelancers or independent contractors has become increasingly popular over the past decade. However, all businesses can benefit from working with independent contractors. If you’re interested in hiring independent contractors for your business, keep reading to find out how to do it the right way.

Business Management Daily

MAY 9, 2024

How does it do that? That’s especially true whenever new changes come about, and 2023 was a year rife with new payroll regulations, trends, and initiatives. From the implementation of SECURE 2.0 to new IRS enforcement initiatives, there’s a lot of payroll administrators need to know. not signing up for your 401(k) plan).

Insperity

MARCH 31, 2022

Sometimes partnerships or contractor agreements must end due to issues with the quality of the work, a change in your business needs or a reduced budget for outsourced services. How can you successfully separate from these individuals while causing the least amount of turmoil? Ending a contractor relationship: legal factors.

HR Lineup

APRIL 8, 2024

In addition to minimum wage requirements, California law mandates overtime pay for non-exempt employees who work more than eight hours in a workday or 40 hours in a workweek. Overtime pay is typically set at one and a half times the regular rate of pay. Failure to provide these breaks can result in penalties for employers.

Patriot Software

MARCH 28, 2022

Taking on an independent contractor is different than hiring an employee. There are differences in the forms you must gather, wage reporting, and how you pay contractors vs. employees. So, how do you run contractor payroll if it’s different from paying employees?

Business Management Daily

DECEMBER 2, 2022

Independent contractor rules are about to change – again. Those rules would have made it simpler and more attractive for employers to use independent contractors. Using independent contractors versus employees. Independent contractors are responsible for their own tax payments. Take taxes.

HR Lineup

APRIL 23, 2024

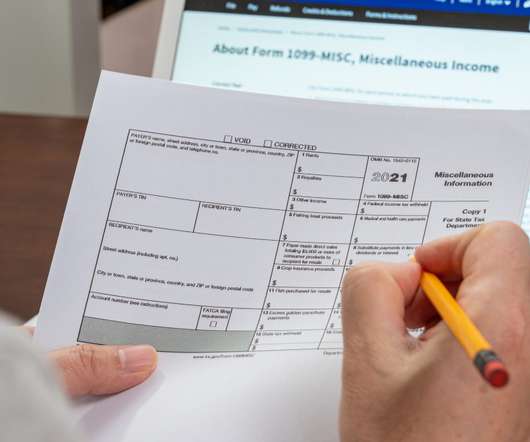

This comprehensive guide will delve into the most common tax forms employers need to know, providing detailed insights into their purposes, and requirements and how to navigate them effectively. This includes independent contractors, freelancers, vendors, and other non-employees who have provided services to your business.

Higginbotham

OCTOBER 13, 2022

Under the final rule, an employer-sponsored plan is affordable for family members if the portion of the annual premium the employee must pay for family coverage (the employee’s required contribution) does not exceed 9.5 DOL Proposes New Independent Contractor Classification Rule. 1, 2023 or after. 11, 2022, the U.S. 13, 2022.

Hppy

SEPTEMBER 4, 2021

You require the services of a contractor, especially when starting a small business. However, businesses grow fast, and when you start thinking of hiring to help out with the company. This article explores whether you should hire an independent contractor or an employee for short-term projects.

Higginbotham

NOVEMBER 15, 2023

One of the most powerful currents in this tide of change is the rise of gig workers, also known as contingent workers, freelancers or contractors. How many participate in the contingent workforce? American Opportunity Survey , 36 percent of all respondents identified as independent workers. According to the McKinsey & Co.

Business Management Daily

NOVEMBER 16, 2022

Both forms provide end-of-year compensation information that employees and contractors need for tax purposes. If you’re not quite sure about the differences between a 1099 and a W-2, keep reading to learn which form to send and how to fill out and file them. What is a W-2? What is a 1099? When to send a 1099 vs. a W-2.

Business Management Daily

NOVEMBER 16, 2020

Every business that hired independent contractors and expects to pay them at least $600 this year must now report on Form 1099-NEC. The form must be received by Independent contractors by February 1, the same day the IRS must receive your paper or electronic forms. Form 1099-MISC is out; Form 1099-NEC is in.

Higginbotham

AUGUST 19, 2022

Keep reading to learn more about how PEOs work and what businesses should consider before using a PEO. Hiring and managing employees requires significant resources. Hiring and managing employees requires significant resources. At the same time, companies often need employees in order to grow. So, what is a PEO?

Business Management Daily

SEPTEMBER 23, 2020

Not only do you want to find the right candidate to complete the job, but you want to ensure that you hire them under the best category to fit your business needs. What is an independent contractor. Independent contractors are self-employed workers. Independent contractor vs employee.

Workers' Compensation

MARCH 4, 2023

LAUNCHING OF AI LANGUAGE-BASED APPLICATIONS Recently a Judge in Columbia admitted to using an AI program, ChatGPT , in writing a decision on whether an autistic child’s insurance should pay the costs of medical treatment. The stated mission of CHAT-AI is, ”Creating safe artificial general intelligence that benefits all of humanity.”

Business Management Daily

MAY 1, 2024

Updating job descriptions is a common step when recruiting new hires, but many HR professionals or small business leaders overlook the need to update job descriptions regularly for current team members. List out all the must-have tasks and competencies that you need an employee to complete if hired for this position.

Business Management Daily

OCTOBER 23, 2023

One option for small businesses that aren’t quite ready to hire in-house human resources support just yet is to outsource. One option for small businesses that aren’t quite ready to hire in-house human resources support just yet is to outsource. However, small businesses can’t always afford to hire in-house HR staff.

Business Management Daily

MAY 15, 2024

The recent advances in artificial intelligence (AI) and tools like ChatGPT are revolutionizing how we all work. You can learn how to write a job description with AI and use AI models for your HR operations. Businesses and employees increasingly use AI for process automation, communications, and more.

Assurance Agency

MARCH 20, 2023

While there have been notable high profile hiring freezes and layoffs, the unemployment rate remains low. The new rule will likely require more workers to be classified as employees, rather than independent contractors. This increases the amount employers need to contribute toward premiums.

Assurance Agency

MARCH 20, 2023

While there have been notable high profile hiring freezes and layoffs, the unemployment rate remains low. The new rule will likely require more workers to be classified as employees, rather than independent contractors. This increases the amount employers need to contribute toward premiums.

Insperity

MARCH 26, 2024

Here’s what you should consider before engaging with gig workers, and how you can maximize your company’s potential for success in this evolving work landscape. Instead, the gig economy refers to workers who are hired by companies on a temporary basis to perform specific tasks or services, or to complete a certain project.

Workplace Insight

FEBRUARY 20, 2023

National borders are no longer a barrier when it comes to hiring workers, either as employees or as independent contractors, with strong digital natives are increasingly sought after. This also means that the world of employment , both for workers and enterprises, is necessarily evolving too.

Insperity

FEBRUARY 11, 2021

Not only do you have to figure out the proper way to pay your people, you have to withhold the appropriate taxes, deposit them and report them to the government. Hire an accountant to handle it. Using an automated payroll service can help you avoid hassles and headaches without being as costly as hiring an accountant.

Business Management Daily

JANUARY 23, 2022

Here’s what you need to know about the 1099-NEC form and how to fill it out and file it. Previously, the 1099-MISC form was used to report income paid to independent contractors, vendors, and sole proprietors. This can include independent contractors, sole proprietors, and attorneys. What is form 1099-NEC?

Workers' Compensation

AUGUST 3, 2022

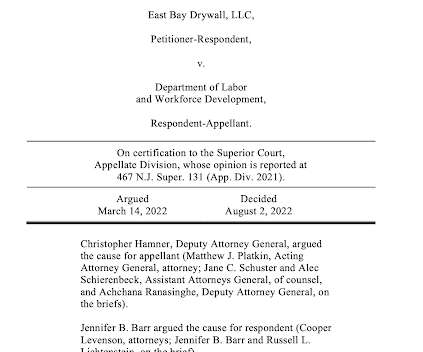

The Commissioner’s finding that East Bay did not supply sufficient information to prove the workers’ independence under the ABC test’s prong C was not arbitrary, capricious, or unreasonable but rather was supported by the absence of record evidence as to that part of the test. Argued March 14, 2022 -- Decided August 2, 2022 FUENTES, P.J.A.D.

InterWest Insurance Services

JULY 26, 2022

For these reasons, it’s important that you understand your insurance coverages and that you know how to address any deficiencies that may exist in your risk management strategy. Also, keep track of new employees that you hire (or let go) during the course of the year, so that adjustments can be made to your policy.

Insperity

JANUARY 27, 2022

Offering competitive pay is but one way to accomplish that, but there are other things you can do. perks or perquisites) are benefits you offer in addition to pay. The IRS’ Publication 15-B (2021) Employer’s Tax Guide to Fringe Benefits defines a fringe benefit as “a form of pay for the performance of services.

Business Management Daily

JUNE 17, 2022

There was the afternoon course over several weeks teaching new hires how to write according to the company’s style guide. (It Other questions request information from employers, employees, and even independent contractors. If yes, how did they evaluate your likelihood of repaying? How much is your debt?

Business Management Daily

AUGUST 10, 2021

Knowing whether the IRS views someone as your employee or as an independent contractor dictates tax obligations and associated paperwork, namely whether you bear responsibility for filing a W-2 or a 1099 for the individual in question. The Social Security Administration (SSA) receives Copy A. Copies B, C, and 2 go to the employee.

Business Management Daily

DECEMBER 2, 2020

A 1099-NEC covers a wide variety of payments made to nonemployees – who could be freelancers, independent contractors, cleaning services, and more. However, the recipient is ultimately responsible for paying estimated income and self-employment taxes. All taxable payments made to employees must be included on their W-2s.

The Workcomp Writer

MARCH 21, 2023

5th 903 (2018), the Supreme Court of California adopted the so-called “ABC test” to categorize workers as employees or independent contractors for the purposes of California wage orders. Under the ABC test, workers are presumed to be employees, and may only be classified as independent contractors if the hiring entity demonstrates: A.

Business Management Daily

MARCH 5, 2021

The Biden Administration has made it clear that pay equity and pro-labor legislation are key priorities. Nearly 60 years after the enactment of the Equal Pay Act (EPA) in 1963, the promise of equal pay for equal work has not been fulfilled. Equal pay is one of Biden’s top domestic priorities. The Paycheck Fairness Act.

Global People Strategist

APRIL 7, 2020

Traditionally, gig-workers (such as those who work with Uber or Skip the Dishes), are considered contractors, and have not previously had access to unemployment benefits like what is offered to traditional, full-time employees. In addition, those who are traditionally self-employed (i.e.

Hppy

MAY 1, 2023

Human resources (HR) teams are essential in workplaces that want to staff healthy and happy employees, but where do 1099 contractors fall into this equation? Are we supposed to treat contractors like employees, or are there nuances that HR teams need to be aware of? Image Source: Unsplash 1. Always read their contract before signing.

Florida Workers' Comp

JUNE 20, 2023

Many of the defendants had been independent contractors instead of employees. They, therefore, struggled with the cost of hiring lawyers. I don't know how serious those lawyers were. It really only decided that the procedure in the case was not appropriate, that the party told to pay "$5.2 West American Ins.

Business Management Daily

OCTOBER 11, 2019

Independent contractors save organizations time, money and hassle by eliminating the hoops employers have to jump through to manage employees. Independent contractors assume responsibility for payroll taxes and workers’ compensation. Employers pay invoices to a 1099 worker—no overtime, no timecards, no problems.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content