1099 vs W-2: The difference between employees and contractors

Business Management Daily

NOVEMBER 16, 2022

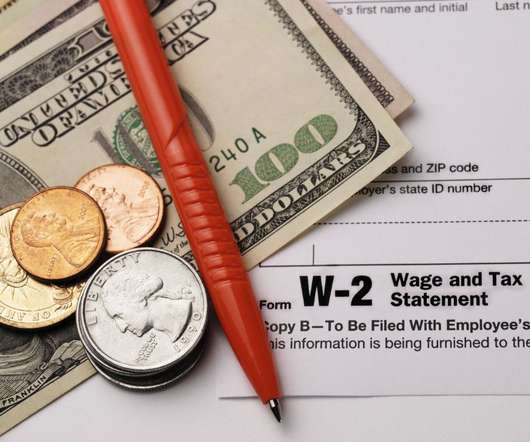

Both forms provide end-of-year compensation information that employees and contractors need for tax purposes. If you’re not quite sure about the differences between a 1099 and a W-2, keep reading to learn which form to send and how to fill out and file them. A 1099 is a form used to report non- employee compensation.

Let's personalize your content