Seasoned Payroll Pro Shares Insights of Recent First Payroll Congress Experience

PayrollOrg

MARCH 5, 2024

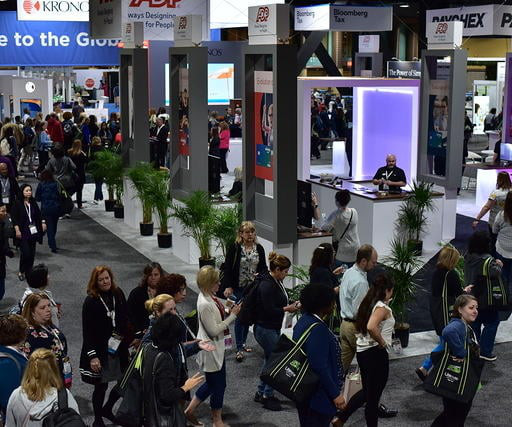

For 15 years, Dawn Curtis, CPP, was one of those payroll professionals who’d never had a chance to attend a Payroll Congress. But that all changed in 2023, when for the first time, PayrollOrg hosted the 41st Annual Payroll Congress in Denver, which allowed Dawn to attend and see for herself what all the excitement is about.

Let's personalize your content