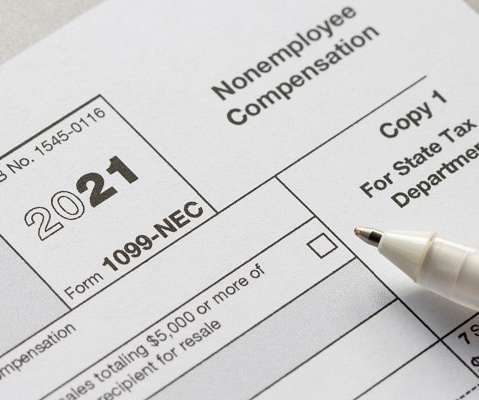

Top payroll documents employers need

PeopleKeep

DECEMBER 7, 2022

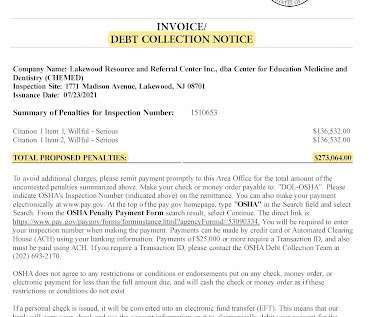

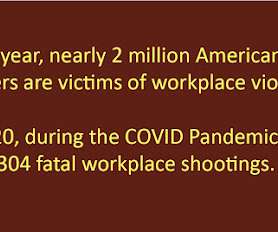

As an employer or human resources professional, you must know the proper documents, forms, and rules for payroll and taxes. Without proper documentation, your organization could violate state and federal laws, resulting in hefty penalties. Looking for more compliance tips for your organization?

Let's personalize your content