Preparing for Your Tax Preparer

Money Talk

FEBRUARY 22, 2024

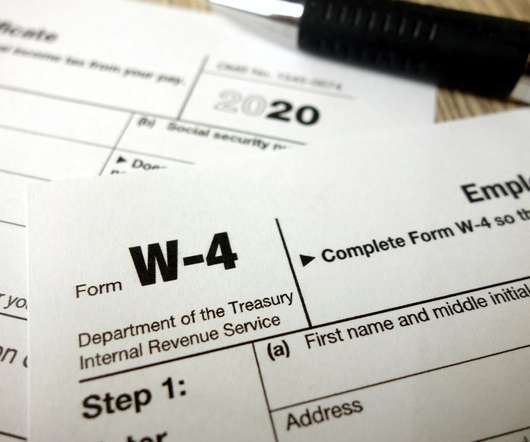

With income tax season well underway, many people are getting ready to see a tax preparer to get their 2023 income tax return prepared and filed before April 15, 2024. Some may have a long-standing tax pro while others are selecting a tax preparer for the first time. About half of U.S. About half of U.S.

Let's personalize your content