Buyer’s guide to flexible benefits technology

Employee Benefits

APRIL 19, 2023

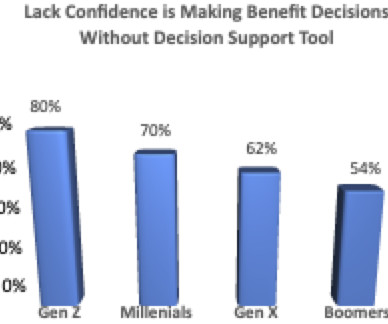

What is flexible benefits technology? At first, benefits technology evolved with the aim of making reward more visible, and allowing for more effective communication. On a practical level, the right provider will allow for an organisation new to benefits technology to start smaller, with a simple, streamlined package.

Let's personalize your content