What are level-funded health benefits?

PeopleKeep

APRIL 3, 2024

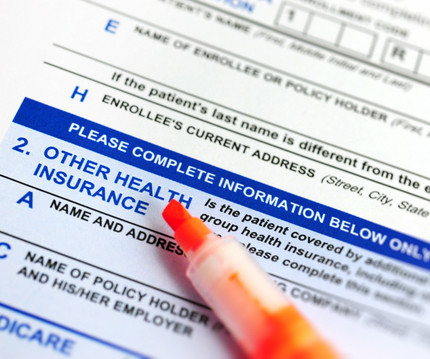

Small to medium-sized businesses (SMBs) often look for creative alternatives to traditional health insurance to offer their employees an affordable and comprehensive health benefit. One option some employers may consider is a level-funded health plan.

Let's personalize your content