Changes Coming to Electronics, Dual-Wage Class Codes

InterWest Insurance Services

MARCH 5, 2024

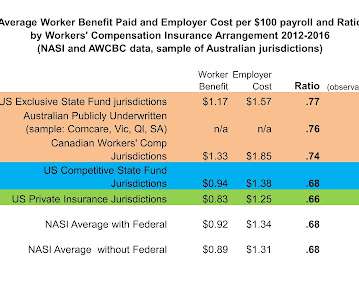

The Workers’ Compensation Insurance Rating Bureau of California will recommend changes to class codes for some electronics manufacturing sectors, as well as increases to the wage thresholds for construction industry dual classifications. per $100 of payroll for class code 3681 will apply to the new combined code.

Let's personalize your content